Built by experts. Designed for insurers. Backed by experience.

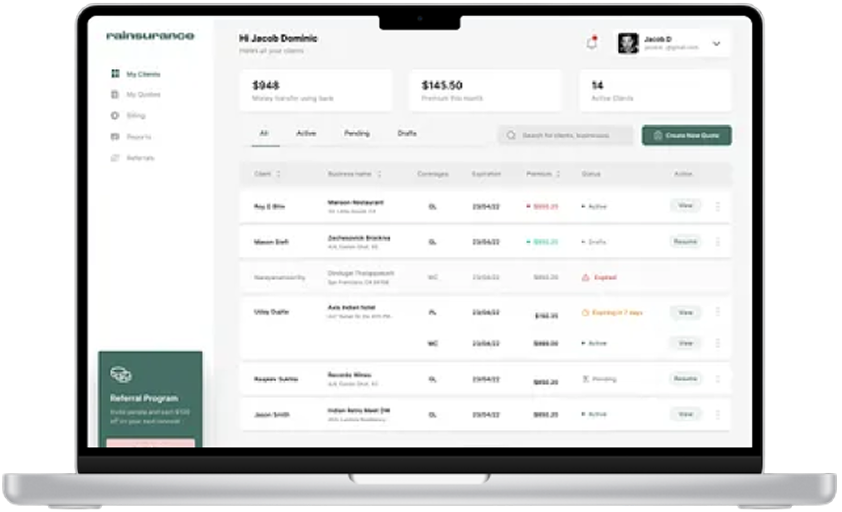

MIS PORT is more than just software—it’s your centralized port where insurance data lands, flows, and lifts off with precision. Whether you’re managing leads, reconciling policies, or tracking payouts, MIS PORT ensures smooth sailing across all operations.

Scale your business without limits. Add agents, managers, telecallers—no cap.

Stay ahead with auto-generated policy payment snapshots every 3 months.

Seamlessly extract data from PDF or Excel—zero manual effort, maximum accuracy.

Handle all transactions—even in the case of policy cancellations or reversals—with ease.

Manage and map policy bank details for future reversals and audits.

Edit, delete, or recreate past policies every action is logged, every change is traceable.

Match MIS data with portal data to detect discrepancies and rate differences automatically.

Get partner/provider payout, cutpay, profit, and balance—all on a single policy screen.

Rates update themselves using your pre-configured logic. One grid to rule them all.

Partner type, base rate, and targets—automatically calculated and updated.

Assign leads to telecallers, set follow-ups, and track policy renewals in one place.

Generate bank-wise, TDS, and provider payment reports including daily expenses (Daybook).

Manage portal access with child accounts, usernames, and custom passwords.

Assign precise access rights for Admins, Agents, SMs, and Telecallers.

Dedicated login dashboards for Agents, Sales Managers, and Telecallers.

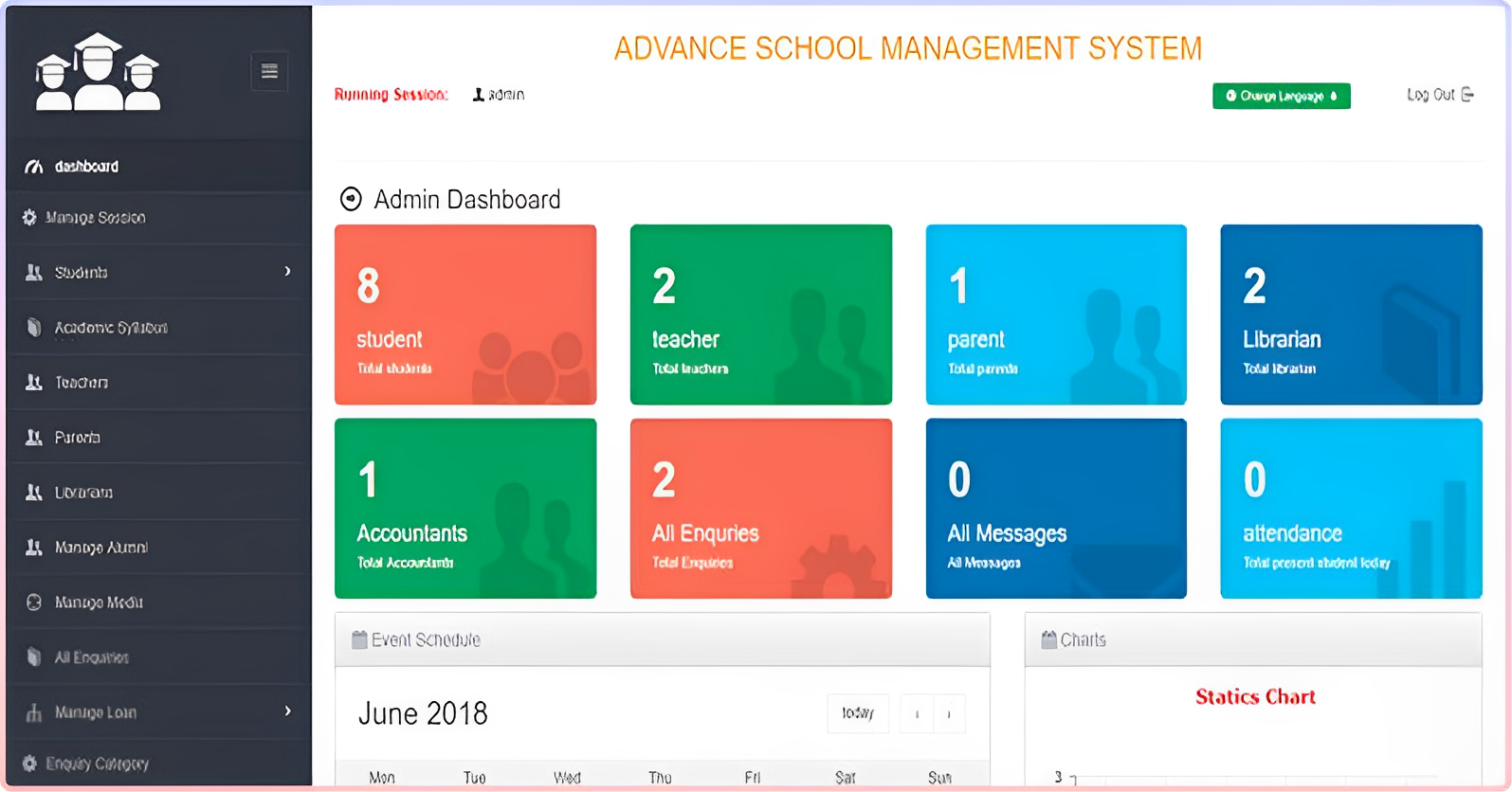

Dashboard

Main Menu

Your real-time business cockpit displaying overall metrics like total policies, premium collected, profit earned, and partner dues—broken down by month, quarter, and policy type.

Create and manage role-based access (e.g., Admin, Agent, SM, Telecaller) to control what each user can view and do within the software.

Manage login credentials and assign roles to users. Control who can access the system and what permissions they have.

Maintain a directory of companies or agents who provide you insurance business. Track deal details and performance by provider.

Policy Module

Management

Define and manage different expense categories like marketing, operations, brokerage, etc.

Record daily or transaction-based expenses. Each expense is linked to a head and partner.

Track interbank transfers made for partner payments, company transfers, or reconciliations.

Generate summarized and detailed reports of expenses by date, head, partner, etc.

Reports

Report on business brought by individual providers-

policy-wise, product-wise, or date-wise.

Analyze individual partner business, payout,

and performance.

Track branch-wise policy performance, income, and

leads.

General reporting on all policies—filters by product,

status, user, and time range.

Bank-wise policy premium collection and partner

payment transactions.

Same as above, but for providers.

Consolidated reports for all providers.

Global partner reports across categories and

lines of business.

View sales manager-wise performance and their

assigned teams' outcomes.

Track edit history, changes made to policies, and

endorsements added.

TDS and GST deductions & filings related to partner

transactions.

Track login times, IPs, user activity logs—important for

audits and security.

Renewal

Stay ahead with real-time tracking of policies nearing expiration or successfully renewed.

Policies that have already crossed their validity date and need immediate attention.

Policies approaching expiration. Useful for renewal alerts.

Renewed policies converted successfully from expiring or expired ones.

Rate Management

Maintain base rates for various

insurance productsand

companies.

Quickly find applicable rates by

selecting insurer, product type,

variant, or category.

Set performance-based targets for partners. If achieved, partners receive bonuses or special rates based on business lines (motor/non-motor/etc.).

Classify partners into categories (e.g., Gold, Silver, Franchisee) for differentiated base rate, payout, and access levels.

Renewal

Efficiently create, track, and manage every stage of your sales

leads — from initial contact to conversion or closure.

Add new leads received via website, telecallers, or walkins.

Leads that are new or yet to be contacted.

Leads currently being followed up by agents or telecallers.

Leads that were not converted to policies due to rejection or non-interest.

Successfully closed leads that resulted in a policy.

Track each lead's status history, actions taken, and performance by telecallers.

We’re just one step away from understanding your needs.

Master Data

Configure default rules, preferences, and startup behavior of the system.

Add and manage the list of your company’s or provider’s banks.

Define types of policies such as motor, health, life, travel, etc.

Master list of insurance companies you deal with.

Define products offered by insurers (e.g., Third Party, Comprehensive, Health Cover, etc.).

Vehicle manufacturer list (e.g., Maruti, Honda, etc.).

Car or bike model mapping under a manufacturer.

Variants within a model like LX, VX, ZXi, etc.

Vehicle Maping

Manually or automatically map insurer's vehicle data to internal master data.

Track mappings done, pending mappings, and mismatches.

Master list of fuel types like petrol, diesel, CNG, electric.

Classify vehicles into categories: private car, bike, goods carrier, passenger vehicle, etc.